A “sexy casino,” where real-estate speculation has moved online.

Polymarket rose to prominence in 2024 by letting users bet on the U.S. presidential election, with trading volume hitting record highs on the night of Trump’s victory.

In November 2025, it signed a partnership with the UFC and entered sports betting. Then, on January 5, 2026, it announced a new experiment:

Betting on home prices.

Polymarket had previously offered markets tied to mortgage rates, but those were essentially derivatives on Federal Reserve policy. This time is different. The new markets allow users to directly bet on whether a specific city’s home price index will rise or fall.

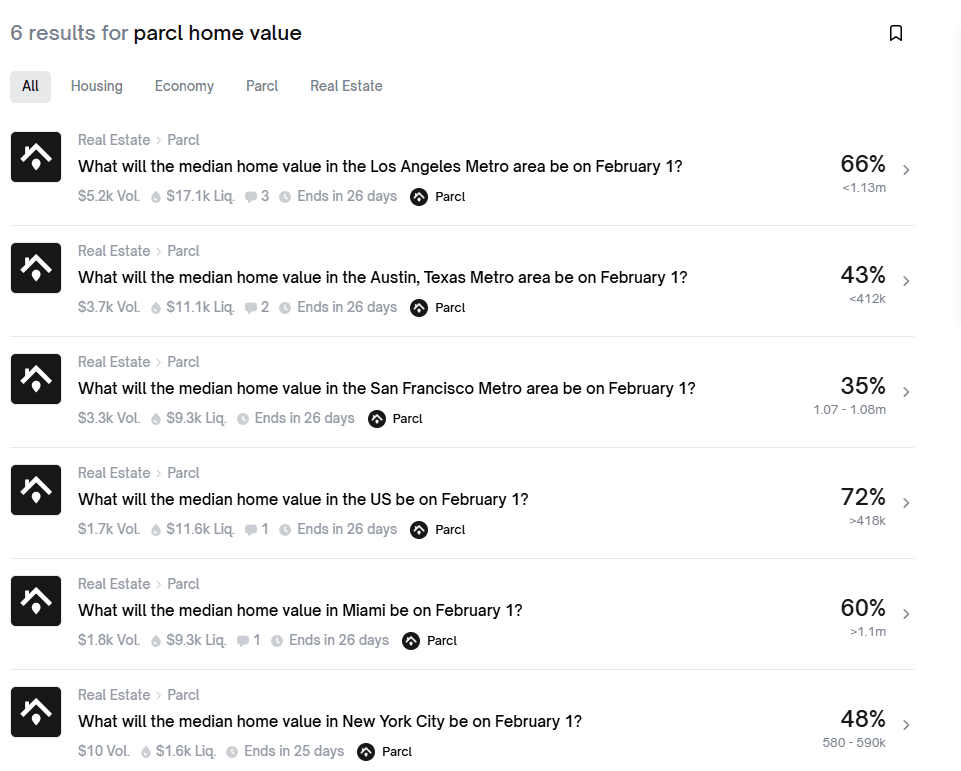

The partner is Parcl, a real-estate data protocol on Solana. The mechanics are simple: choose a city and predict whether its home price index will go up or down next month.

The initial markets include Austin, San Francisco, Miami, New York, plus a national U.S. index.

No down payment.

No mortgage application.

No dealing with agents.

Bet USD 100. Get it right and double your money. Get it wrong and it goes to zero.

Polymarket’s CMO argues that real estate is the world’s largest asset class—worth USD 400 trillion—and therefore deserves to be a “first-class citizen” in prediction markets.

A USD 400 trillion casino, with the entry ticket now reduced to:

The price of a cup of coffee.

This is not entirely new.

Back in 2008, the UK betting exchange Betfair already offered markets on a housing crash. What happened that year needs no retelling. Wall Street was trading CDS, MBS, and CDOs—acronyms few ordinary people understood, but everyone ended up paying for them.

Polymarket has simply translated the same idea into plain language:

Will Miami home prices rise or fall before February 1? Pick one.

According to the partnership announcement, settlement data is provided by Parcl and updated daily—faster than traditional housing indices. Each market comes with a dedicated settlement page detailing final values, historical trends, and calculation methodology.

Transparent. Public. Verifiable on-chain.

It sounds appealing. But current market data tells a quieter story. Even the most liquid market barely has USD 17,000 in liquidity. New York’s market sits at around USD 1,600, and after two days online, total trading volume there was just USD 10.

People are enthusiastic about betting on presidents. Betting on housing prices? It seems most haven’t figured out how to play yet.

For now, this looks less like a mass market—and more like an early adopter playground. Or, put differently:

A hunting ground for whales.

Parcl raised two funding rounds in 2022, with investors including Dragonfly, Coinbase Ventures, and Solana Ventures, totaling over USD 11 million.

Its earlier products were far more aggressive: long and short positions on housing indices, up to 10x leverage, perpetual contracts.

Yes—real estate trading with leverage.

After partnering with Polymarket, the design became more restrained. No leverage. No perpetuals. Just simple binary options: up or down, settle at expiry.

Polymarket itself has been expanding rapidly. Valued at USD 1.2 billion in 2024, by the end of 2025 the parent company of the NYSE, ICE, announced plans to invest USD 2 billion, pushing its valuation close to USD 9 billion.

From betting on presidents, to boxing, to home prices—the catalog keeps expanding. What’s next is unclear. Divorce rates? Birth rates? How long the bubble tea shop downstairs can survive?

As long as there is a data source, anything can become a market.

On-chain analytics have already shown that nearly 70% of Polymarket users lose money, with profits concentrated in a very small number of wallets.

That ratio looks familiar—to crypto trading, and to stock trading as well.

The difference is this: election outcomes are discrete and definitive. You win or you lose. Housing data is not. It comes with lags, noise, seasonality, and methodological disputes. You may think you are making a judgment, but in reality you are betting against statistical definitions.

The traditional logic of buying a home is straightforward: 30% down, a 30-year mortgage, monthly payments that may exceed your salary—but at least the house is yours.

The Polymarket version of “buying a home” is different: bet USD 100, wait a month, double it or lose everything. The house is never yours. It never was.

Which one looks more like gambling?

The last wave of financialized real estate ended with the subprime crisis in 2008. This time, retail traders are allowed at the table.

What progress.

You may also like

Key Market Intelligence for February 5th, how much did you miss out on?

Wintermute: By 2026, crypto had gradually become the settlement layer of the Internet economy

Tether Q4 2025 Report: USDT Market Cap Nears $190 Billion, Multiple Metrics Reach All-Time Highs

Kyle Samani's about-face, one of the biggest believers in web3, has also left the industry

Bhutan Quietly Sells Over $22M in Bitcoin, Drawing Speculation Over Possible Moves

Key Takeaways Bhutan has transferred over $22 million in Bitcoin from sovereign wallets in the past week. The…

BitMine Endures a $7B Unrealized Loss as Ethereum Dips Below $2,100

Key Takeaways BitMine is facing a significant financial challenge with an unrealized loss of over $7 billion in…

Trump-Linked World Liberty Financial Under Scrutiny Following $500 Million UAE Stake

Key Takeaways A U.S. House investigation is examining a $500 million UAE stake in Trump-related World Liberty Financial.…

Asia Market Open: Bitcoin Tumbles as Asian Equities Reflect Global Tech Retreat

Key Takeaways: Bitcoin’s price plunged by 6% to $72,000, reflecting the spillover effects from the global tech sector’s…

Crypto Firms Propose Concessions to Banks as Stablecoin Disputes Stall Key Crypto Bill

Key Takeaways: Crypto companies are attempting to navigate stablecoin disputes with banks but agreements remain elusive. Industry representatives…

CoolWallet Introduces TRON Energy Rental to Minimize TRX Transaction Costs

Key Takeaways CoolWallet has integrated TRON’s energy rental services, offering users lower transaction fees while maintaining asset security.…

CFTC Officially Withdraws Biden-Era Proposal to Ban Political and Sports Prediction Markets

Key Takeaways: The CFTC has rescinded a 2024 proposal and subsequent 2025 advisory that aimed to prohibit event…

Binance Says Assets Rose Amid Alleged Bank Run Attempt

Key Takeaways: Binance reported an unexpected increase in assets during a community-driven withdrawal campaign, challenging conventional expectations of…

Same Macro Tape, Different Bid – Gold Absorbs Flows as Bitcoin Swings

Key Takeaways: Gold is experiencing significant demand growth, especially via ETFs and central banks, projecting a robust performance…

Crypto Price Prediction Today, February 4 – Focus on XRP, Cardano, and Dogecoin

Key Takeaways Bitcoin is facing significant pressure, affecting the entire cryptocurrency market, including heavyweights like XRP, Cardano, and…

Vitalik Buterin Urges Ethereum Builders to Innovate Beyond Clone Chains

Key Takeaways Vitalik Buterin criticizes the trend of creating copy-paste EVM chains, encouraging developers to focus on truly…

Best Crypto to Buy Now February 4: XRP, Solana, Hyperliquid Picks

Key Takeaways XRP remains one of the top picks for cross-border transactions due to its high speed and…

XRP Price Prediction: Ripple Quietly Unlocks a Billion Tokens – Is a Price Shock Coming in the Next Few Hours?

Key Takeaways Ripple has released one billion XRP tokens into the market, potentially causing a shift in XRP…

Google’s Gemini AI Predicts the Price of XRP, Ethereum, and Solana By the End of 2026

Key Takeaways Google’s Gemini AI forecasts significant growth for XRP, anticipating a price of up to $8 by…

Key Market Intelligence for February 5th, how much did you miss out on?

Wintermute: By 2026, crypto had gradually become the settlement layer of the Internet economy

Tether Q4 2025 Report: USDT Market Cap Nears $190 Billion, Multiple Metrics Reach All-Time Highs

Kyle Samani's about-face, one of the biggest believers in web3, has also left the industry

Bhutan Quietly Sells Over $22M in Bitcoin, Drawing Speculation Over Possible Moves

Key Takeaways Bhutan has transferred over $22 million in Bitcoin from sovereign wallets in the past week. The…

BitMine Endures a $7B Unrealized Loss as Ethereum Dips Below $2,100

Key Takeaways BitMine is facing a significant financial challenge with an unrealized loss of over $7 billion in…

Earn

Earn