ETH Denver Recap and Reflection, Crypto in the Midst of a Structural Shift

Original Article Title: The Last Cycle: An ETH Denver Retrospective

Original Article Author: TraderNoah, Theia Team Member

Original Article Translation: ChatGPT

Editor's Note: ETH Denver reflected the shift in the crypto industry—reduced speculation, increased pragmatism. Market participants can be divided into old-timers, technical builders, newcomers, and speculators, with fewer and fewer actually making money. The crypto industry has entered a new stage, with a clear trend towards institutionalization and a slowdown in pure crypto-native market growth. With regulatory clarity, stablecoins and on-chain finance will see widespread adoption, and the traditional VC exit model is now well recognized. The surge in 2024 was more of a financial game, and after the bubble burst, the industry faces a reality check: either create real business value or continue to wait for the next speculative cycle.

Below is the original content (slightly restructured for ease of comprehension):

There are few new faces, reduced extravagant marketing spending, and a shift in industry trends towards pragmatism. Legacy projects from the past still exist (e.g., lingering infrastructure projects from 2018 or VC firms that have just been overfunded burning cash on marketing), but compared to previous years, this phenomenon has diminished.

Background

Currently, there are primarily two main groups in the industry: the crypto-native group and newcomers.

These can be further subdivided into four subcategories:

Crypto-native Mercenaries

Crypto-native Technocrats

Low-quality Newcomers

High-quality Newcomers

Crypto-native Group

This group is mainly composed of technocrats (VC/investors, VC-backed projects), focusing on significant market opportunities and dedicated to building tangible products. In this event, they accounted for over two-thirds of the crypto-native group, primarily focusing on AI/DeFi and FinTech directions.

The number of mercenaries is significantly lower than in previous years, which could be due to:

· A subdued on-chain market

· Future growth leaning more towards institutionalization

· Most mercenaries have either been liquidated or have earned enough money, leaving few behind, and few are willing to go all-in on this game anymore.

Newcomers

Newcomers can be divided based on their skill level.

Low-Quality Newcomers: Primarily engaged in soft-skill-related work (BD, Growth, Ecosystem, etc.), usually working for a declining L1/L2 project or a well-funded but directionless company. These individuals may be crypto enthusiasts, or they may simply be staying due to the industry's high salaries and low job intensity.

High-Quality Newcomers can be divided into Technocrats and Mercenaries:

· Technocrats mainly come from traditional finance, building in areas such as DeFi, Stablecoins, or are infrastructure experts in AI, DeFi, security, focusing on technologies and capital deployment in early-stage projects with significant market potential.

· Mercenaries are usually young entrepreneurs aged 18-25 who witnessed the wealth accumulation of their predecessors in 2021 and are looking to replicate that success. They are charismatic, intelligent, and even slightly antisocial. This group is not large in size but often garners significant industry attention.

Reassessment Phase

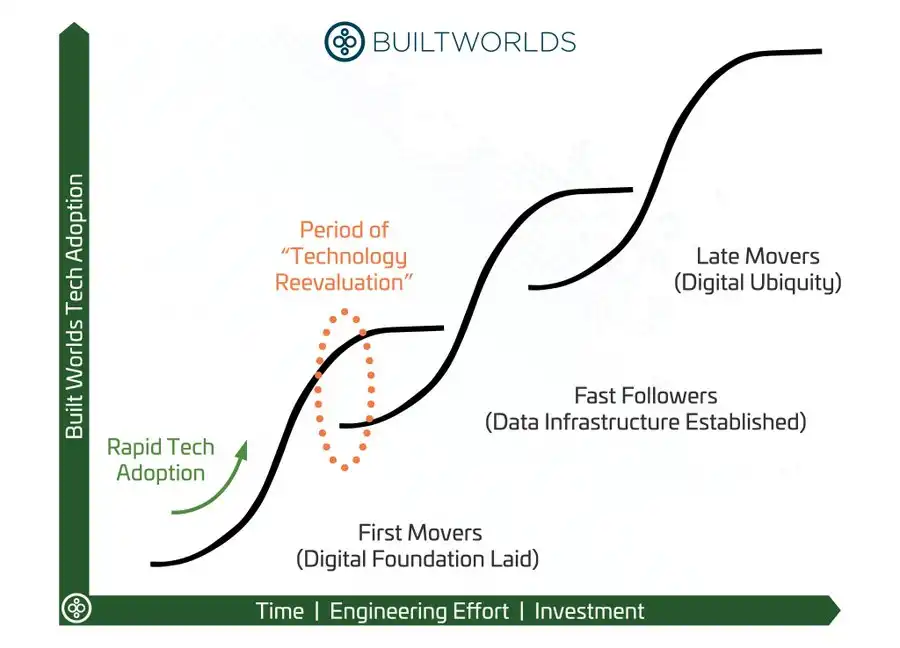

Why is blockchain technology seeing widespread adoption while our token prices are plummeting? Why are some groups remaining optimistic while others are pessimistic? The answer is simple: we are at the end of one S-curve and the beginning of another.

Retrospective of the Crypto Industry

2009-2011: Early Tech Geeks

2011-2016: Dark Web / Gambling Era

2017-2019: Mainstream's First Cycle

2020-2021: DeFi Summer, Mainstream's Second Cycle

2022-2024: Speculators / Vulture Capital, Mainstream's Second/Third Cycle

The above is a highly summarized classification, but I believe it is fundamentally accurate. People who entered the crypto industry early on usually fell into one of three categories: tech geeks, criminals, or just lucky timing.

Those who entered the crypto industry before 2017 can now be roughly divided into three scenarios:

Already financially free, choose to retire

Consider cryptocurrency as a way of life

Still struggling to make money

After the DeFi Summer, a large number of newcomers entered the crypto industry, indicating that those who entered after 2020 are more akin to the general public compared to earlier adopters. Many in this group have seen wealth growth, but extreme wealth accumulation is less common compared to the early adopters.

Their current status can be roughly divided into:

A few have achieved financial freedom and retired

Most are in the middle of the wealth spectrum, holding the power of choice

Some are in a state of "pre-affluence" but are gradually becoming disillusioned with the industry

From 2024 onwards, people from all walks of life will come into contact with cryptocurrency, but only those who can identify business opportunities and have exceptional abilities will survive. We may see a large number of executives with traditional finance or Web2 experience entering the space.

Looking back at the participants in the crypto industry, those who are still active can be roughly divided into three categories:

"Pre-affluent" but entered before 2022: In the past 5-10 years, they missed opportunities, and many are disillusioned with the industry.

"Post-affluent" and deeply believe in crypto (like religious believers, e.g., ETH Maximalists, Link Marines): These individuals still consider ETH as "money" but have not been actively involved for years, disconnecting from the market.

Newcomers seeking business opportunities: They have not been influenced by past market fluctuations and remain optimistic.

Among these, the most pessimistic are usually the first category, as they harbor deep jealousy and resentment towards the industry, realizing that their wealth accumulation largely came from luck or shady means.

The second category firmly believe that ETH is still "money." They speak grandiosely on podcasts or work in fund companies but have long been out of touch with market reality.

The third category remain optimistic because they have not been worn down by past market cycles, or they still focus on their beliefs. Today, as regulatory frameworks become clearer, stablecoins see widespread adoption, and the financial markets accelerate towards tokenization.

Future Development Directions?

The entire industry has essentially reached a consensus on the direction in the coming years, but those who cannot benefit from the new landscape often choose to selectively ignore reality. In the future, the marginal new users will pay more attention to how cryptocurrency can create value in their real lives. We may see:

· Significant growth in on-chain financial applications

· More applications of crypto technology in security and reducing backend operational costs

However, the growth of the purely crypto-native market may slow down, which is not very favorable for token fund inflows and may also be one of the reasons for the sluggishness of the liquid market.

The current industry is in a transition period where regulation has not yet been fully established but is imminent. In the future, liquidity may shift towards compliant public market stocks rather than tokenized assets. Additionally, many on-chain financial products may require identity verification to attract institutional clients, leading to a split of the on-chain financial market into gray/black market and compliant market.

Uncertainty implies risk, and although the industry's long-term trend is positive, this may not necessarily benefit everyone's investment portfolio.

ETH Denver: A Wake-Up Call for the Industry

ETH Denver and its surrounding market trends have sounded an alarm for the entire crypto industry. Market participants are now facing a stark choice:

· Shift towards building or investing in real businesses to drive the practical application of blockchain technology;

· Continue to pray for the "crypto casino" to restart, hoping for windfall profits in the next bull run.

As genuinely business valuable projects gradually emerge and the "crypto casino" opportunity relatively diminishes, this choice becomes increasingly clear.

In fact, many industry participants (companies, traders, funds) have long been in decline, merely hesitant to accept reality due to the market's long feedback loop or overcapitalization.

This transformation all began with the Bitcoin ETF in 2024 and culminated with Trump's inauguration in 2025. The market is slowly evolving towards a more rational direction, with less and less room for blind speculation.

In the early cycles (2017, 2021), the "average person" might have willingly immersed themselves in the Ponzi game, pretending ignorance. However, eight years have passed since the first crypto frenzy, and more and more people have come to terms with reality:

VC -> TGE (Token Generation Event) -> Cash Out, the old routine, is fundamentally a funding game. But as long as this path remains profitable, it won't change, yet fewer and fewer people are willing to continue being duped.

The crypto industry is undergoing a structural transformation, and the era of the casino is fading as genuine business models rise.

The 2024 market surge was primarily driven by the wealth effect brought by Bitcoin and the meme coin hype cycle. But this time around, traders are all too aware; they're only participating when there's money to be made, having no faith in any narrative.

Today, the era of free money is over, the gamblers have left the building, and industry participants relying on market liquidity must now reassess the impact on their investment portfolios.

You may also like

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

Earn

Earn