Life charts can't cure anxiety, and predicting the market can't foresee the outcome

Source: TechFlow (Shenchao)

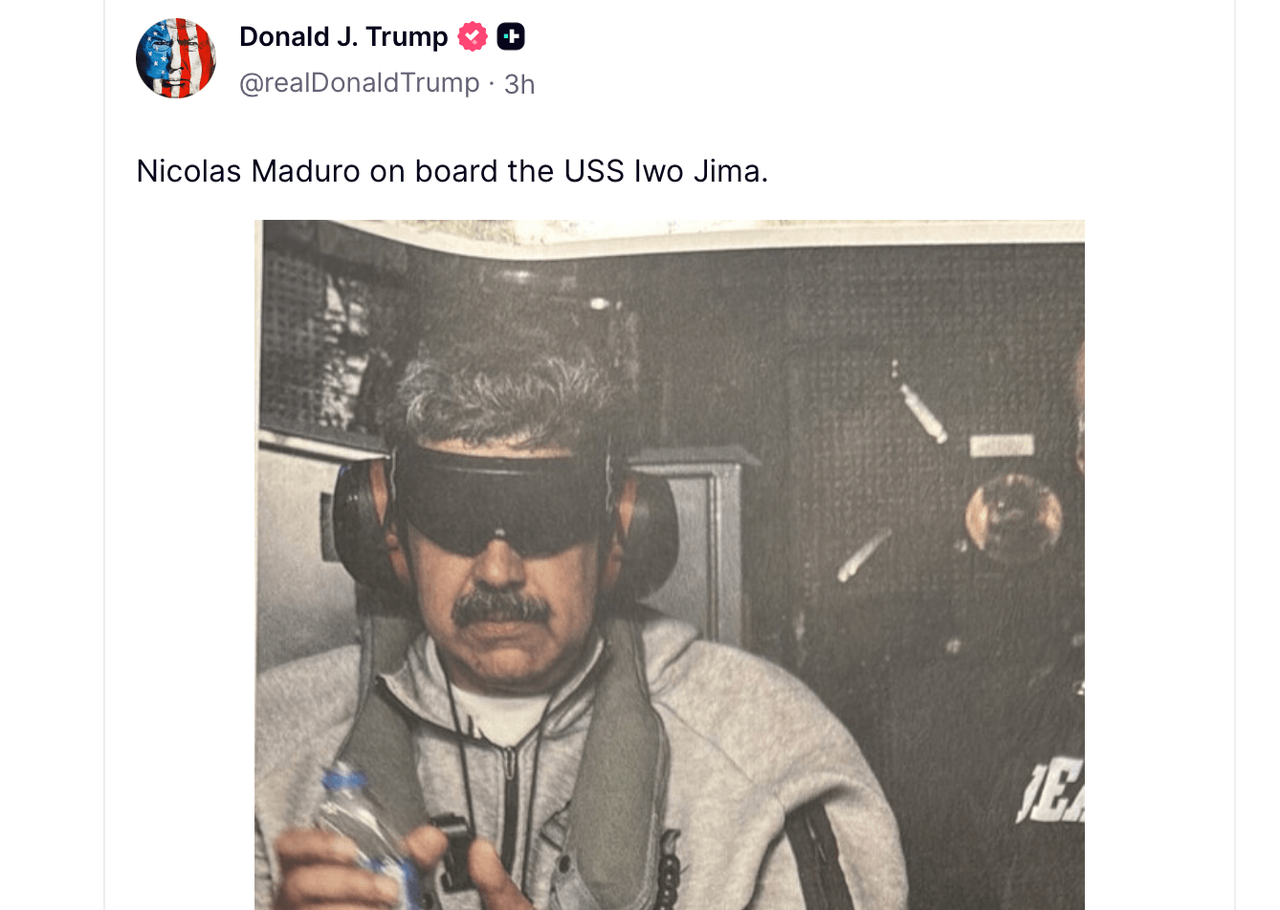

At the beginning of 2026, a sudden geopolitical event shocked the world: On January 3, the United States launched a military operation codenamed "Operation Absolute Resolve," successfully capturing President Nicolás Maduro and his wife Celia Flores, and quickly transporting them to New York to face criminal charges in Manhattan federal court, including drug terrorism conspiracy, cocaine import conspiracy, and weapons charges.

Despite the long-standing standoff between the US and Venezuela, the secrecy and explosiveness of this operation completely defied expectations. Just 24 hours before the raid, everything seemed normal in Caracas, with no public signs of a breakdown in diplomatic efforts. This event quickly made global headlines, not only for its political significance but also because it revealed a stark reality: true historical turning points often occur in the blink of an eye.

Just before the raid, contracts on Polymarket betting on Maduro's potential removal from power were trading at only about 5 to 7 cents, meaning the market generally considered him extremely safe in the short term. No one anticipated his arrest, which brought huge profits to traders who placed bets shortly before the operation was made public.

Despite the unpredictability of life, humanity's desire to predict the future has never been more urgent. At the end of 2025, two tools unexpectedly formed a kind of intertextuality: one is the "life chart," which visualizes the Chinese astrological system, and the other is a prediction market that presents odds on global events.

We attempt to use the former to calculate an individual's fate and the latter to predict the world's destiny. What they both promise is a quantifiable future.

Life charts, through symbolic visualization, provide a sense of certainty; prediction markets, through price signals, offer probabilistic certainty. It seems that by reading these signals early enough, we can prepare in advance, hedge against uncertainty, and seemingly gain a head start. But is this truly the case?

The viral popularity of life charts reflects a psychological need for certainty. Users input their birth information, AI automatically generates a chart, predicts major life cycles, and outputs a candlestick chart; the fluctuations of the graph provide a readable life curve. Under the dual pressures of employment and emotional fluctuations, it acts as a coordinate axis, providing a framework for self-narration and emotional catharsis. This candlestick chart doesn't sell science, but rather meaning and comfort—unquestionable emotional value.

Prediction markets, on the other hand, promise verifiable predictions through financialized language. In 2025, Polymarket and Kalshi dominated the prediction market sector, with sports, political, and economic events becoming predictable and betting targets, and trading volume extending from peak election periods to everyday life. Platforms allowed users to place bets with real money, and prices formed a probabilistic consensus amidst liquidity and divergence.

Amidst the triple anxieties of economic volatility, geopolitical tensions, and AI disruption, young people don't need accurate predictions, but rather the illusion that their destiny is in their hands. These two types of tools offer two heterogeneous forms of "control," seemingly allowing them to hedge against macroeconomic risks and gain an edge in an uncertain world by simulating life and event trajectories in advance.

However, such preparation inevitably has limitations and even carries significant risks. Cultural biases introduced by model training, algorithmic black boxes, and "black swan" events like Maduro's arrest all demonstrate the questionable accuracy of future predictions.

But such preparation inevitably has limitations and carries significant risks. Cultural and algorithmic biases introduced by model training, and the risks of black swan events, all indicate that the true accuracy of future predictions is questionable. The risks of over-focusing on predictions cannot be ignored. While life charts may be presented as entertainment, they can influence crucial individual choices. Cases of market manipulation are frequent, with insider trading and large-scale price manipulation being proven realities.

But this isn't the most dangerous aspect. A deeper crisis lies in the fact that the act of observation itself can interfere with the system, a concept already metaphorically described by Heisenberg's uncertainty principle. The more users blindly trust the probabilities output by tools, the more likely they are to lose their keen intuition for sudden risks. We stare at dashboards for so long that we forget to look up and see where we're going.

Predictive tools can identify trends, but they can never foresee true turning points. They are rearview mirrors, reflecting current anxieties and consensus, but unable to become searchlights illuminating the fog.

Ultimately, uncertainty is the underlying code of the world. After the frequent black swan events of 2025, the best preparation is not staring at candlestick charts or odds on a screen, but acknowledging the limitations of algorithms.

After all, real life often unfolds beyond the candlestick charts. Going with the tide and building individual resilience amidst immense uncertainty may be the only true path we can truly grasp.

You may also like

Key Market Intelligence for February 5th, how much did you miss out on?

Wintermute: By 2026, crypto had gradually become the settlement layer of the Internet economy

Tether Q4 2025 Report: USDT Market Cap Nears $190 Billion, Multiple Metrics Reach All-Time Highs

Kyle Samani's about-face, one of the biggest believers in web3, has also left the industry

Bhutan Quietly Sells Over $22M in Bitcoin, Drawing Speculation Over Possible Moves

Key Takeaways Bhutan has transferred over $22 million in Bitcoin from sovereign wallets in the past week. The…

BitMine Endures a $7B Unrealized Loss as Ethereum Dips Below $2,100

Key Takeaways BitMine is facing a significant financial challenge with an unrealized loss of over $7 billion in…

Trump-Linked World Liberty Financial Under Scrutiny Following $500 Million UAE Stake

Key Takeaways A U.S. House investigation is examining a $500 million UAE stake in Trump-related World Liberty Financial.…

Asia Market Open: Bitcoin Tumbles as Asian Equities Reflect Global Tech Retreat

Key Takeaways: Bitcoin’s price plunged by 6% to $72,000, reflecting the spillover effects from the global tech sector’s…

Crypto Firms Propose Concessions to Banks as Stablecoin Disputes Stall Key Crypto Bill

Key Takeaways: Crypto companies are attempting to navigate stablecoin disputes with banks but agreements remain elusive. Industry representatives…

CoolWallet Introduces TRON Energy Rental to Minimize TRX Transaction Costs

Key Takeaways CoolWallet has integrated TRON’s energy rental services, offering users lower transaction fees while maintaining asset security.…

CFTC Officially Withdraws Biden-Era Proposal to Ban Political and Sports Prediction Markets

Key Takeaways: The CFTC has rescinded a 2024 proposal and subsequent 2025 advisory that aimed to prohibit event…

Binance Says Assets Rose Amid Alleged Bank Run Attempt

Key Takeaways: Binance reported an unexpected increase in assets during a community-driven withdrawal campaign, challenging conventional expectations of…

Same Macro Tape, Different Bid – Gold Absorbs Flows as Bitcoin Swings

Key Takeaways: Gold is experiencing significant demand growth, especially via ETFs and central banks, projecting a robust performance…

Crypto Price Prediction Today, February 4 – Focus on XRP, Cardano, and Dogecoin

Key Takeaways Bitcoin is facing significant pressure, affecting the entire cryptocurrency market, including heavyweights like XRP, Cardano, and…

Vitalik Buterin Urges Ethereum Builders to Innovate Beyond Clone Chains

Key Takeaways Vitalik Buterin criticizes the trend of creating copy-paste EVM chains, encouraging developers to focus on truly…

Best Crypto to Buy Now February 4: XRP, Solana, Hyperliquid Picks

Key Takeaways XRP remains one of the top picks for cross-border transactions due to its high speed and…

XRP Price Prediction: Ripple Quietly Unlocks a Billion Tokens – Is a Price Shock Coming in the Next Few Hours?

Key Takeaways Ripple has released one billion XRP tokens into the market, potentially causing a shift in XRP…

Google’s Gemini AI Predicts the Price of XRP, Ethereum, and Solana By the End of 2026

Key Takeaways Google’s Gemini AI forecasts significant growth for XRP, anticipating a price of up to $8 by…

Key Market Intelligence for February 5th, how much did you miss out on?

Wintermute: By 2026, crypto had gradually become the settlement layer of the Internet economy

Tether Q4 2025 Report: USDT Market Cap Nears $190 Billion, Multiple Metrics Reach All-Time Highs

Kyle Samani's about-face, one of the biggest believers in web3, has also left the industry

Bhutan Quietly Sells Over $22M in Bitcoin, Drawing Speculation Over Possible Moves

Key Takeaways Bhutan has transferred over $22 million in Bitcoin from sovereign wallets in the past week. The…

BitMine Endures a $7B Unrealized Loss as Ethereum Dips Below $2,100

Key Takeaways BitMine is facing a significant financial challenge with an unrealized loss of over $7 billion in…

Earn

Earn