Why is it that in the cryptocurrency field, projects often face difficulties in delivery, also known as "The ICO Curse"?

Original Article Title: Why Crypto Can't Build Anything Long-Term

Original Article Author: rosie

Original Article Translation: Odaily Planet Daily Golem

Most of the crypto founders I know are now on their third pivot. This group developed an NFT platform in 2021, shifted to DeFi yield in 2022, pivoted to AI agents in 2023/24, and are now chasing this quarter's hot trend (maybe prediction markets).

Their pivots aren't wrong, and in many ways, their strategies are right. But the issue is that this pattern itself makes it difficult to build anything that can last long-term.

18-Month Product Cycle

New concept emerges → Funds pour in → Everyone pivots → Sustained growth for 6-9 months → New concept fades → Pivot again.

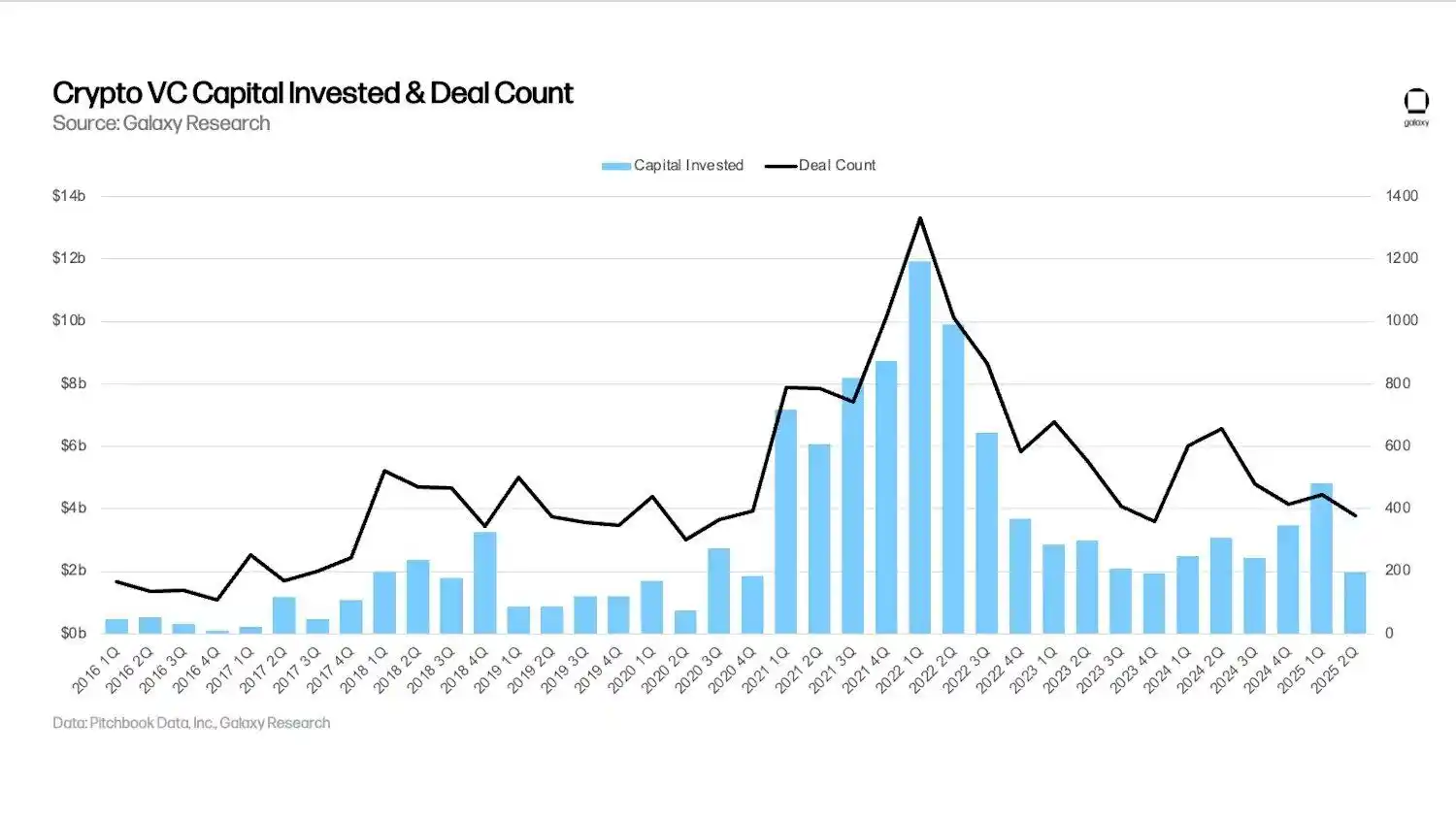

A crypto cycle used to last 3-4 years (ICO era), then shortened to 2 years, and now, if lucky, a crypto cycle lasts at most 18 months. By the second quarter of 2025, crypto VC funding dropped nearly 60%, leaving crypto founders without enough time and funding to develop before the next narrative compels them to pivot again.

It's nearly impossible to build anything meaningful in 18 months; true infrastructure takes at least 3-5 years, and achieving product-market fit truly takes years, not quarters of iteration.

But if crypto founders stick to last year's narrative, they are wasting money, investors will leave, users will churn. Some investors will even force crypto founders to chase the current trend, and their team will start evaluating investments in projects that secured funding based on this quarter's hot narrative.

Sunk Cost Fallacy as a Survival Mechanism

The traditional business advice is not to fall into the sunk cost fallacy. If a project isn't working, pivot immediately. But the crypto space is deeply entrenched in it, using the sunk cost fallacy as a survival mechanism. Now, no one sticks around long enough to validate if what they're doing actually works — facing resistance, pivoting; slow user growth, pivoting; fundraising challenges, pivoting.

Every crypto founder faces this tradeoff:

· Keep building the existing product, maybe achieving success 2-3 years down the line. If lucky, you might secure another round of funding.

· Embrace the hot narrative: raise funds immediately, show superficial progress, and exit before anyone realizes it's not working.

In most cases, the second option wins out.

Projects Forever About to Be Completed

Few crypto projects ever truly complete what they set out to do in their roadmap. Most projects are always in a state of being "about to be completed." Always one feature away from achieving product-market fit. They never get there because halfway through, the winds shift, and overnight, finishing your DeFi protocol becomes irrelevant because everyone is talking about AI agents.

The market punishes completed projects. Because a finished product has its known limitations, while an "about to be completed" product still has infinite narrative potential.

Capital Chases Attention, Not Completion

In crypto, if you have a new narrative, you can raise $50 million even without a product; if the narrative is established, the product is live, you might struggle to raise even $5 million; if it's an old narrative, with a product and real users, then funding might not be possible at all.

Venture capitalists don’t invest in products; they invest in attention. Attention flows to new narratives, not established ones. Most teams now are solely focused on "narrative maximization," optimizing entirely for which story attracts funds, not caring about what they are actually doing. Completing a project boxes you in, while abandoning one keeps your options open.

Team Retention

If you're a crypto founder, when the new narrative arrives, your best engineers might get poached, receiving double the pay to join the latest hot project; your marketing director might be lured by a company that just raised a billion dollars. You can't compete because you abandoned the hot narrative six months ago to truly finish what you started.

No one wants to be part of a boring stable project. They want chaos, excess capital, projects that may fail but could also bring tenfold returns.

User Attention Span

Crypto users sometimes engage with a product simply because it's new, because everyone is talking about it, or because there might be an airdrop. Once the narrative shifts, they move on, and whether the product has improved, or if the requested features have been added, no one cares anymore.

In fact, we cannot build sustainable products for unsustainable users. Some crypto founders pivot so many times that even they forget the original mission.

Decentralized social network -> NFT marketplace -> DeFi aggregator -> Gaming infrastructure -> AI agent -> Prediction market... Transformation is no longer a strategic issue but has become the core of the entire business model.

Infrastructure Paradox

In the crypto space, the things that endure are mostly those that were established before cryptocurrency gained attention. Bitcoin emerged when no one cared, without VCs, and without an ICO. Ethereum was born before the ICO frenzy, before people could envision the future of smart contracts.

Most things born during hype cycles will fade with the end of the cycle, while those born before the cycle are more likely to succeed. Yet few will build before a narrative begins due to lack of funding, attention, and exit liquidity.

Why is This Hard to Change?

Token-based incentive structures create liquidity exit opportunities. As long as founders and investors can exit before the product matures, they will.

The speed of information and emotion spreading far exceeds the speed of construction. By the time a project is done, everyone knows how it turned out. The entire value proposition of the crypto industry is evolving rapidly, demanding slow evolution in a rapidly evolving sector is like expecting it to turn into something it was not meant to be.

This means that if you spend three years building a product, someone else can copy your idea and launch a product with worse code and better marketing strategy in three months. And then they win.

Cryptocurrencies struggle to build any long-term products because structurally they are at odds with long-term thinking.

You can be a principled founder, refuse to pivot, stay true to the original vision, take years instead of months to develop. But you are likely to go bankrupt, be forgotten, and eventually be replaced by those who pivoted three times while you were launching your first version.

The market does not reward completion, but it rewards constantly creating new things. Perhaps the true innovation in the crypto industry lies not in the technology itself, but in how to achieve the maximum value with the minimum input.

You may also like

Bitcoin Experiences Record 23% Decline in Early 2026

Key Takeaways Bitcoin has experienced a record-setting decline of 23% in the first 50 trading days of 2026.…

Whale Holding 105,000 ETH Faces $8.5 Million Loss

Key Takeaways A significant Ethereum holder, often termed a “whale,” has accumulated long positions in 105,000 ETH. The…

Bitcoin Faces Liquidity Challenges as $70,000 Rebound Struggles

Key Takeaways Bitcoin’s attempts to break the $70,000 mark face significant challenges due to weak liquidity and market…

Newly Created Address Withdraws 7,000 ETH from Binance

Key Takeaways A newly created cryptocurrency address withdrew 7,000 ETH from Binance within an hour, totaling $13.55 million.…

Balancer Halts reCLAMM-Linked Liquidity Pools for Security Check

Key Takeaways Balancer has temporarily halted reCLAMM-related liquidity pools due to security concerns. A report from the bug…

Whales Take on Ethereum: Major Profits from Leveraged Short Positions

Key Takeaways Three Ethereum whales are collectively reaping over $24 million in unrealized profits from short positions. The…

SlowMist Unveils Security Vulnerabilities in ClawHub’s AI Ecosystem

Key Takeaways SlowMist identifies 1,184 malicious skills on ClawHub aimed at stealing sensitive data. The identified threats include…

Matrixport Anticipates Crypto Market Turning Point as Liquidity Drains

Key Takeaways Matrixport notes a surge in Bitcoin’s implied volatility due to a sharp price drop. Bitcoin price…

Bitmine Withdraws 10,000 ETH from Kraken

Key Takeaways A newly created address linked to Bitmine withdrew 10,000 ETH from Kraken. The withdrawal value amounts…

In the face of the Quantum Threat, Bitcoin Core developers have chosen to ignore it

Don't Just Focus on Trading Volume: A Guide to Understanding the "Fake Real Volume" of Perpetual Contracts

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…

Lagarde’s Possible Early Exit Could Alter Digital Euro Plans and Stablecoin Oversight

Key Takeaways Christine Lagarde’s potential departure as ECB president may disrupt the digital euro timeline and stablecoin policies.…

Bitcoin Experiences Record 23% Decline in Early 2026

Key Takeaways Bitcoin has experienced a record-setting decline of 23% in the first 50 trading days of 2026.…

Whale Holding 105,000 ETH Faces $8.5 Million Loss

Key Takeaways A significant Ethereum holder, often termed a “whale,” has accumulated long positions in 105,000 ETH. The…

Bitcoin Faces Liquidity Challenges as $70,000 Rebound Struggles

Key Takeaways Bitcoin’s attempts to break the $70,000 mark face significant challenges due to weak liquidity and market…

Newly Created Address Withdraws 7,000 ETH from Binance

Key Takeaways A newly created cryptocurrency address withdrew 7,000 ETH from Binance within an hour, totaling $13.55 million.…

Balancer Halts reCLAMM-Linked Liquidity Pools for Security Check

Key Takeaways Balancer has temporarily halted reCLAMM-related liquidity pools due to security concerns. A report from the bug…

Whales Take on Ethereum: Major Profits from Leveraged Short Positions

Key Takeaways Three Ethereum whales are collectively reaping over $24 million in unrealized profits from short positions. The…