Bitcoin Surges Towards $120K, Analysts Foresee Heightened Volatility Ahead

Bitcoin has staged a dramatic late-week rally, propelling it towards the crucial $120,000 resistance level as the weekly close approaches. Market participants are bracing for potentially larger price swings, with key liquidation zones and significant trading behavior dominating analyst discussions.

Key Takeaways:

- BTC exhibits a strong late-week comeback, targeting significant liquidation zones and aiming to retake critical price areas.

- Traders and analysts highlight specific price points that Bitcoin must conquer to sustain upward momentum.

- Volatility is expected based on large-volume trading behavior, analysis reports.

Bitcoin Volatility Surges as Weekly Close Looms

Data reveals Bitcoin’s determined ascent, now approaching a pivotal resistance zone. The BTC/USD trading pair is attempting to secure a daily close above its 10-day Simple Moving Average (SMA). This rebound, stemming from lows near $114,500, marks a significant recovery, seemingly overshadowing the memory of one of the largest Bitcoin sales in history.

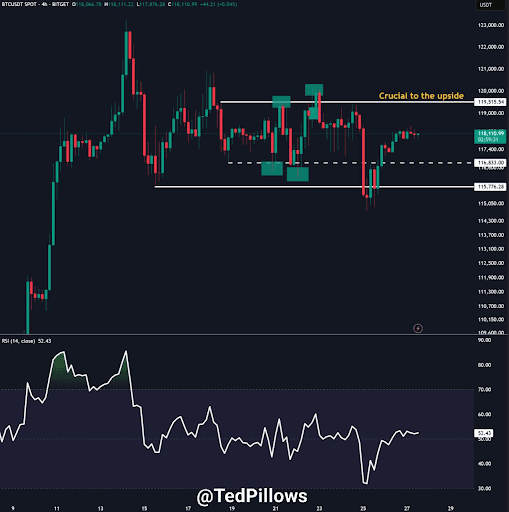

Crypto investor and entrepreneur Ted Pillows commented on X, stating, “$BTC needs to break above $119.5K for a big move. If that doesn’t happen, this consolidation will continue. I think BTC could break above this level next month, which will start the next leg up.”

“$BTC needs to break above $119.5K for a big move. If that doesn't happen, this consolidation will continue,” crypto investor and entrepreneur Ted Pillows summarized in a post on X.

“I think BTC could break above this level next month which will start the next leg up.”

Popular trader and analyst Rekt Capital eyed a slightly higher range ceiling just below the $120,000 mark.

“Bitcoin has Daily Closed above the blue Range Low, kickstarting a break back into the very briefly lost Range,” he told X followers alongside a print of the daily BTC/USD chart.

“Any dips into the Range Low (confluent with the new Higher Low) would be a retest attempt to confirm the reclaim.”

Others warned that price could still fill the daily downside wick left by the trip to $114,500.

In an X thread on the topic, fellow trader CrypNuevo identified a downside target confluent with an area of exchange order-book liquidity.

“If we zoom out, we can see that the main liquidation level is at $113.8k,” he commented.

“Larger Price Swings” Predicted as Liquidation Levels Come into Focus

Recent data places the “max pain” for Bitcoin shorts at approximately $119,650. Should Bitcoin push towards challenging all-time highs near $123,000, short liquidations could exceed a staggering $1.1 billion.

Crypto analysis platform Coinank, examining its own liquidity data, concurred with the resistance: “Strong resistance forming around 119,000–120,000, indicated by dense liquidation clusters.”

Analyst TheKingfisher further highlighted the potential for amplified volatility on shorter timeframes. Reporting on X on Sunday, they observed, “Seeing predominantly red on the BTC GEX+ chart. This indicates dealers are heavily short gamma, suggesting they may amplify volatility to hedge their positions.”

You may also like

Gold at $5,000: Is PAXG Still a Buy? 2026 Price Prediction and the “Sovereign Debt Apex” Explained

Gold has surged past the $5,000 mark recently, driven by global economic pressures and investor flight to safe-haven…

The $320 Trillion Global Pivot: Why PAXG is the Ultimate “Exit Strategy” from the Traditional Banking System in 2026

As global debt hits a staggering $320 trillion, economies worldwide grapple with instability, pushing investors toward reliable alternatives.…

Beyond HODLing: 3 Professional Strategies to Earn Yield on Your Gold with PAXG in 2026

As we move into 2026, PAX Gold (PAXG) continues to stand out in the crypto space by bridging…

PAXG vs. Gold ETFs: Why 24/7 Instant Liquidity is Killing the Traditional “Paper Gold” Market in 2026

As we move deeper into 2026, the gold investment landscape has shifted dramatically, with tokenized assets like PAX…

The Only Federally Regulated Gold Token: Why Paxos’s OCC National Trust Charter Makes PAXG the Safest Bet in 2026

In the fast-evolving crypto landscape of 2026, PAX Gold (PAXG) stands out as the only gold-backed token under…

What is 首个Gifts新模式代币税给创始人 (GIFTS) Coin?

首个Gifts新模式代币税给创始人 (GIFTS) has officially joined the roster of tradeable pairs on WEEX, being available for trading since February…

GIFTS USDT World Debut on WEEX: Gifts Mode Token Launches Feb 5

WEEX Exchange is thrilled to announce the global exclusive first launch of the First Gifts New Mode Token…

What is Incentiv (CENT) Coin?

Incentiv (CENT) was recently listed on WEEX, expanding the trading opportunities for crypto enthusiasts. As of February 05,…

CENT USDT World Premiere on WEEX: Incentiv (CENT) Coin Listing

WEEX Exchange proudly announces the world premiere listing of Incentiv (CENT) Coin, a groundbreaking Layer-1 blockchain, with CENT/USDT…

What is The Toilet (TOILET) Coin?

The Toilet (TOILET) coin is the latest whimsical addition to the crypto market, humorously drawing inspiration from a…

WEEX Premieres The Toilet (TOILET) Coin with TOILET USDT Listing

WEEX Exchange is thrilled to announce the exclusive world premiere listing of The Toilet (TOILET) Coin, bringing fresh…

What is Bitelions (BTL) Coin?

We are thrilled to announce that Bitelions (BTL) is now available for trading on WEEX, with trading having…

WEEX Lists Bitelions (BTL) Coin: BTL USDT Trading Live

As a seasoned crypto trader with over a decade in the market, I’ve seen tokens like Bitelions (BTL)…

What is The Big Trout (BIGTROUT) Coin?

The Big Trout (BIGTROUT) is making waves in the crypto waters with its anticipated debut on the WEEX…

WEEX Lists The Big Trout (BIGTROUT) Coin & BIGTROUT USDT Pair

WEEX Exchange has officially listed The Big Trout (BIGTROUT) coin, opening up exciting opportunities for crypto traders to…

2026 Gold Above $5,000: Why PAXG (Pax Gold) Is the Most Compliant Way to Hold Gold Today

Gold surged past $5,000 in 2026. Learn why PAXG tokenized gold, Paxos regulation, and WEEX trading tools are reshaping modern gold investment strategies.

Cardano (ADA) 2026: Is Cardano Finally Delivering in 2026? A Roadmap of Leios, Midnight, and Voltaire

Cardano 2026 explained: Ouroboros Leios, Midnight NIGHT, governance, and ADA price prediction. A deep analysis of scaling, privacy, and long-term adoption.

Can I Invest in Silver 2026? Is It Too Late to Invest in Silver?

As silver prices surge past $120 per ounce in early 2026, reaching all-time highs and outperforming gold by significant margins, investors worldwide are asking the same urgent question: "Is it too late to invest in silver?" This comprehensive guide examines whether silver still presents a compelling investment opportunity in 2026, analyzing the powerful fundamental forces driving prices higher and providing actionable insights for both new and experienced investors.

Gold at $5,000: Is PAXG Still a Buy? 2026 Price Prediction and the “Sovereign Debt Apex” Explained

Gold has surged past the $5,000 mark recently, driven by global economic pressures and investor flight to safe-haven…

The $320 Trillion Global Pivot: Why PAXG is the Ultimate “Exit Strategy” from the Traditional Banking System in 2026

As global debt hits a staggering $320 trillion, economies worldwide grapple with instability, pushing investors toward reliable alternatives.…

Beyond HODLing: 3 Professional Strategies to Earn Yield on Your Gold with PAXG in 2026

As we move into 2026, PAX Gold (PAXG) continues to stand out in the crypto space by bridging…

PAXG vs. Gold ETFs: Why 24/7 Instant Liquidity is Killing the Traditional “Paper Gold” Market in 2026

As we move deeper into 2026, the gold investment landscape has shifted dramatically, with tokenized assets like PAX…

The Only Federally Regulated Gold Token: Why Paxos’s OCC National Trust Charter Makes PAXG the Safest Bet in 2026

In the fast-evolving crypto landscape of 2026, PAX Gold (PAXG) stands out as the only gold-backed token under…

What is 首个Gifts新模式代币税给创始人 (GIFTS) Coin?

首个Gifts新模式代币税给创始人 (GIFTS) has officially joined the roster of tradeable pairs on WEEX, being available for trading since February…

Earn

Earn